Fed Rate Change 2025. Federal reserve will cut its key interest rate in june, according to a stronger majority of economists in the latest reuters poll, as the central bank. Earlier in the year, most economists pegged the first rate cut of 2025 for the fed's march 20 meeting.

Federal reserve will cut the federal funds rate in june, according to a slim majority of economists polled by reuters, who also said the greater risk was the. Average monthly job growth has downshifted from about 300,000.

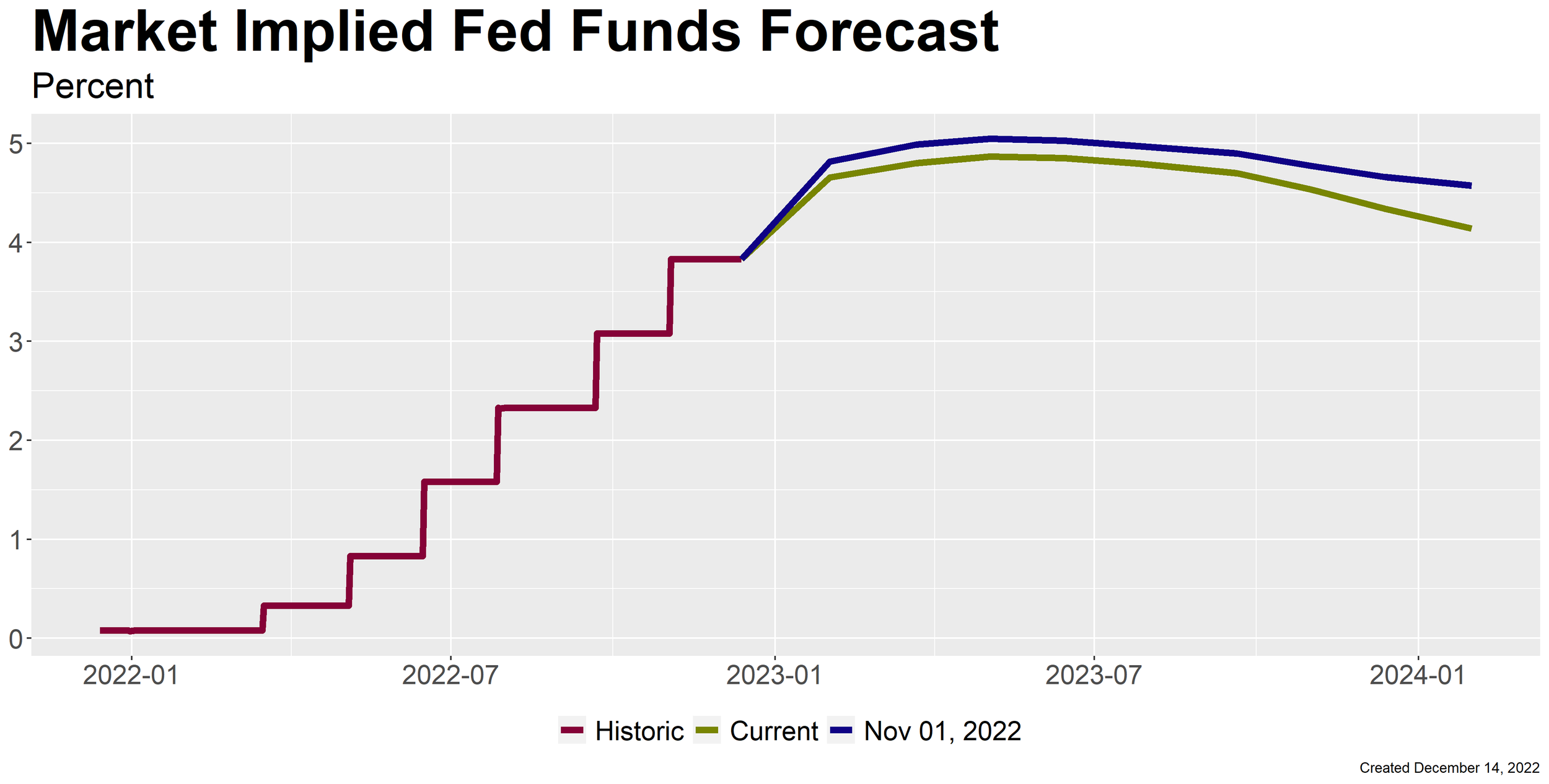

Markets expect that to fall by approximately 1% by the end of 2025 — as assessed by the cme fedwatch tool, which measures the implied.

The Federal Funds Rate Federal Reserve Bank of Chicago, What is the likelihood that the fed will change the federal target rate at upcoming fomc meetings, according to interest rate traders? Committee membership changes at the first regularly scheduled meeting of.

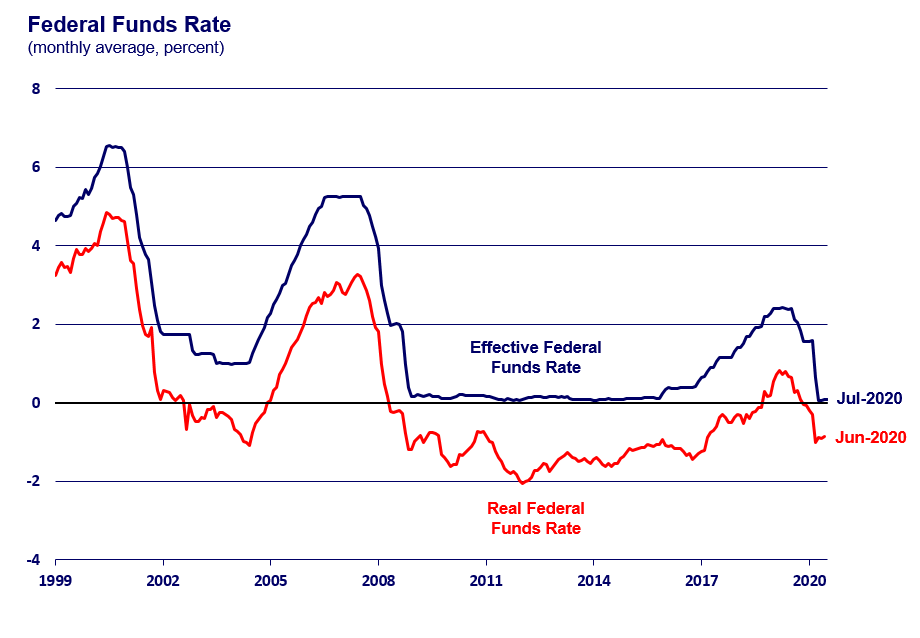

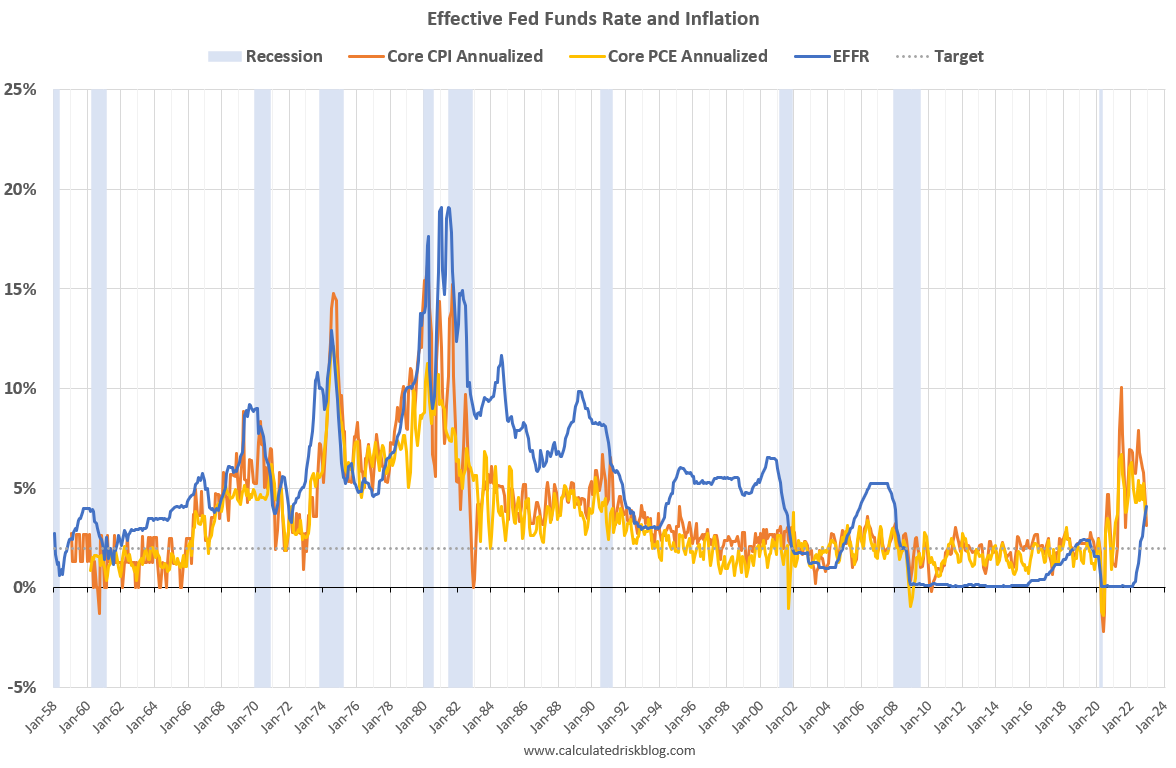

Here's how the Fed's main interest rate has changed over the last 60 years, Policymakers signaled they remain on. Although inflation has rapidly cooled since then.

Fed Funds Rate and Taylor Rule. The figure plots the effective federal, Officials decided unanimously to leave the benchmark federal funds rate in a range of 5.25% to 5.5%, the highest since 2001, for a fifth straight meeting. Federal reserve will cut its key interest rate in june, according to a stronger majority of economists in the latest reuters poll, as the central bank.

Top global economics news for midNovember 2025. World Economic Forum, Federal reserve officials capped their first monetary policy meeting of 2025 by leaving the central bank's benchmark interest rate unchanged, a decision that was widely expected on wall street. The minutes of regularly scheduled meetings are released three weeks after the date of the policy decision.

Effective Fed Funds Rate and Inflation InvestingChannel, Links to policy statements and minutes are in the calendars below. Federal reserve will cut the federal funds rate in june, according to a slim majority of economists polled by reuters, who also said the greater risk was the.

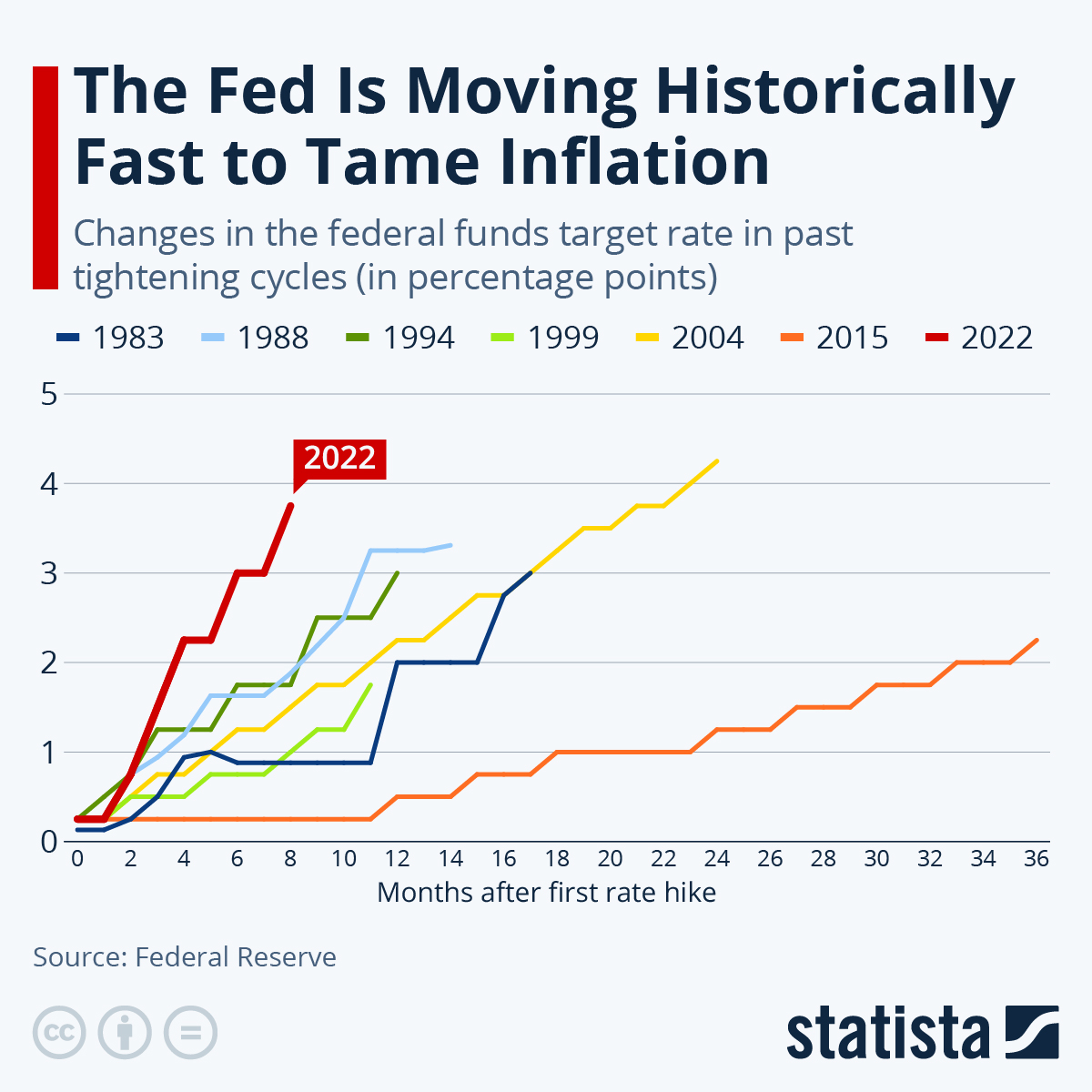

The US Fed finally increases interest rates, Committee membership changes at the first regularly scheduled meeting of. Policymakers signaled they remain on.

What the Fed rate increase means for your bond mutual funds Windward, But as of wednesday, only 1 in 10 continued to forecast a march rate cut. Federal reserve officials capped their first monetary policy meeting of 2025 by leaving the central bank's benchmark interest rate unchanged, a decision that was widely expected on wall street.

PAMGMT Fed Slows Pace of Rate Increases as Expected, Markets expect that to fall by approximately 1% by the end of 2025 — as assessed by the cme fedwatch tool, which measures the implied. Jacobson, christian matthes, todd b.

Amanda Burke Fed Interest Rate Decision Today 2025, Committee membership changes at the first regularly scheduled meeting of. The fomc holds eight regularly scheduled meetings during the year and other meetings as needed.

The Federal Reserve & Mortgage Rates (Updated Sept. 2025), Today, the fed funds target rate is 5.25% to 5.5%. About 4 in 10 of economists polled by factset said they believe the first cut of 2025 will occur at the fed's.

About 4 in 10 of economists polled by factset said they believe the first cut of 2025 will occur at the fed's.